Numbers flash behind your eyes; impossible sums of room and board, tuition and fees, your meager paychecks barely able to make a dent in what will become the debt that follows you far into your adult life.

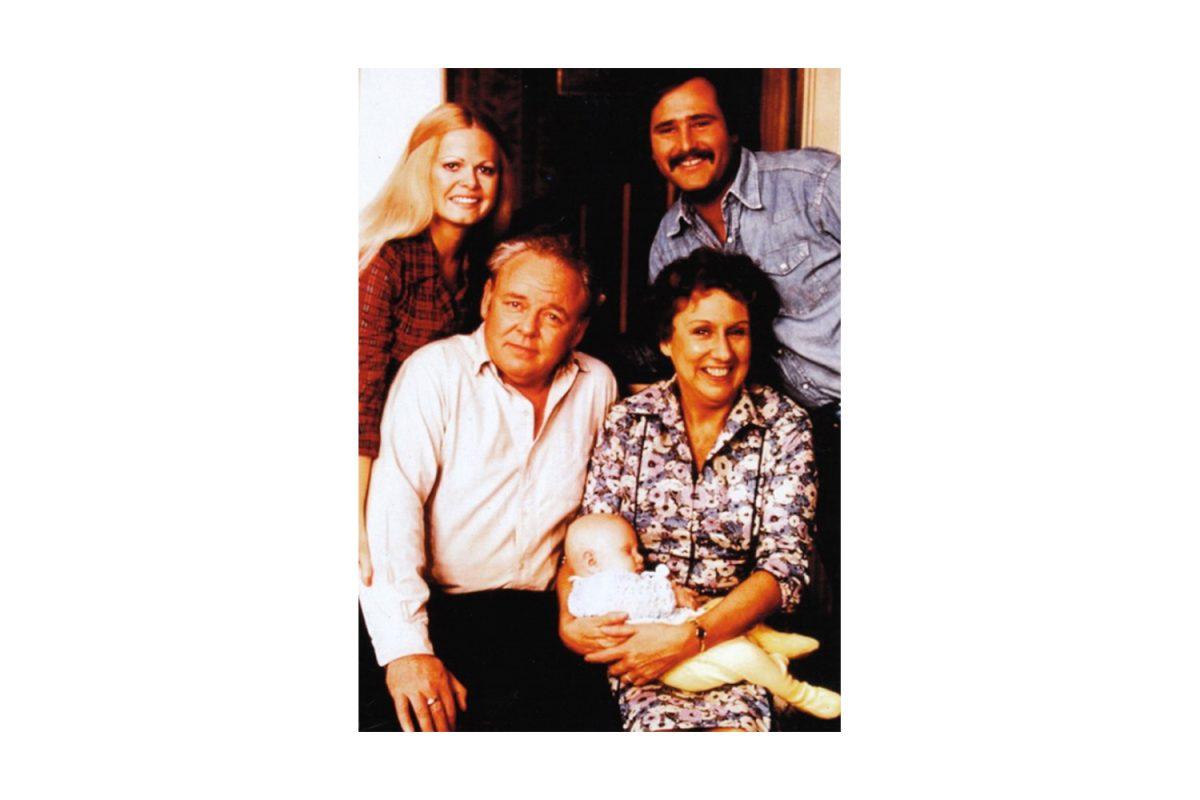

Your grandfather takes a sip of his coffee and says, “You act like it’s so hard to pay for college, but I did it. You’ll be fine. It’s going to take a lot more work than you’re used to, that’s for sure.”

This scenario is all too familiar for high school students today. Adults spout tales of working hard to pay for college with summer jobs, brushing off teenagers as lazy for their complaints about scraping together money. But as tuitions rise steeper than part-time wages, today’s high schoolers now find that working their way through college is much more difficult.

Thirty years ago, a student would need to work just under 470 hours at minimum wage to pay for in-state tuition at the University of Oregon, according to enrollment reports. Today, they would need to work nearly 1,130 hours. It is not laziness that prevents students today from working their way through college without excessive debt; it is the sheer improbability of making enough money to pay for skyrocketing tuition.

Though working remains an important part of financing for college, teenagers often cannot earn enough money with today’s wages to afford tuition. This struggle becomes more difficult when students attend expensive schools with impressive reputations.

Pressure to attend top schools can damage a person’s future instead of improving it. This is not to say that students should choose the cheapest college that they are accepted into. Some schools that initially seem too expensive can often become possibilities when opportunities are taken to reduce the cost. Simply, the academic, social and financial fit of a school is more important than the power held in its name.

Madeline Kokes, Grant High School’s career coordinator, notes the pitfalls of taking excessive student loans at a renowned school. “It’s a lot of pressure,” she says. “You’re going to immediately have to get into a job where you can make enough money to make the monthly payments, so that limits your options in terms of jobs that are available to you and you can pursue.”

Though the previous generations’ method of working through college can’t function in today’s world, new paths can be formed. Arguably the most important part of financing for college today is applying for scholarships. When students apply to colleges without looking for scholarship programs that the schools offer, they are often put at a disadvantage if their top picks are out of financial range.

Whether it is need-based or merit-based, a scholarship from a university itself can provide tens of thousands of dollars annually in financial support. Scholarships from outside organizations also help; they usually provide around a few hundred to a few thousand dollars, but as there is no limit to the number of these scholarships that a person can apply to, the resources add up.

Students can also seek out unconventional methods to cut the cost of college. Grant senior Nina Shuping has found a way to drastically cut the cost to attend the University of Hawaii with the help of the Western Undergraduate Exchange, a program that offers discounted prices to certain colleges for students living in select US states and territories. She will be paying $35,000 annually, significantly lower than the $50,000 sticker price.

When searching for the path after high school that fits them best, some students find that it isn’t college at all. Sean McManus, a Grant senior looking to become an electrician, will attend trade school, a vocational training program that propels students straight into the workforce. “I don’t see myself going to college really, and that was something I’ve known for a while,” McManus says. “I like working with my hands … and I learned that (being an electrician) is good pay.”

Alternative options such as trade school yield jobs with similar or even higher wages than those that require college degrees. According to UA Local 290, a local trade union, a person who takes an apprenticeship will have a cumulative income almost $420,000 higher than that of a person who has a bachelor’s degree upon 25 years of employment. Trade school may be the post-high school path that those interested in careers such as manufacturing, electrical and construction have been looking for.

For those who are interested in attending college, it is crucial to seek out opportunities as early as possible. Whether it is merit, need or diversity-based, it is vital that students make the most of their scholarship opportunities.

The students who have benefited from these opportunities attest to the importance of this. Rie Durnil, a Grant senior, will be a part of Gonzaga University’s Work Study program, taking on-campus jobs to pay for tuition that she otherwise wouldn’t have been able to afford.

“(Without Work Study) I wouldn’t have been able to go,” says Durnil. “If you really want something, do whatever you can to go for it. Sometimes it doesn’t work out, but sometimes, it will.”